dupage county sales tax rate 2020

The 025 sales tax reduction might not sound like a lot but on a big purchase like a new car or a major repair it could mean significant savings. There are a total of 495 local tax jurisdictions across the.

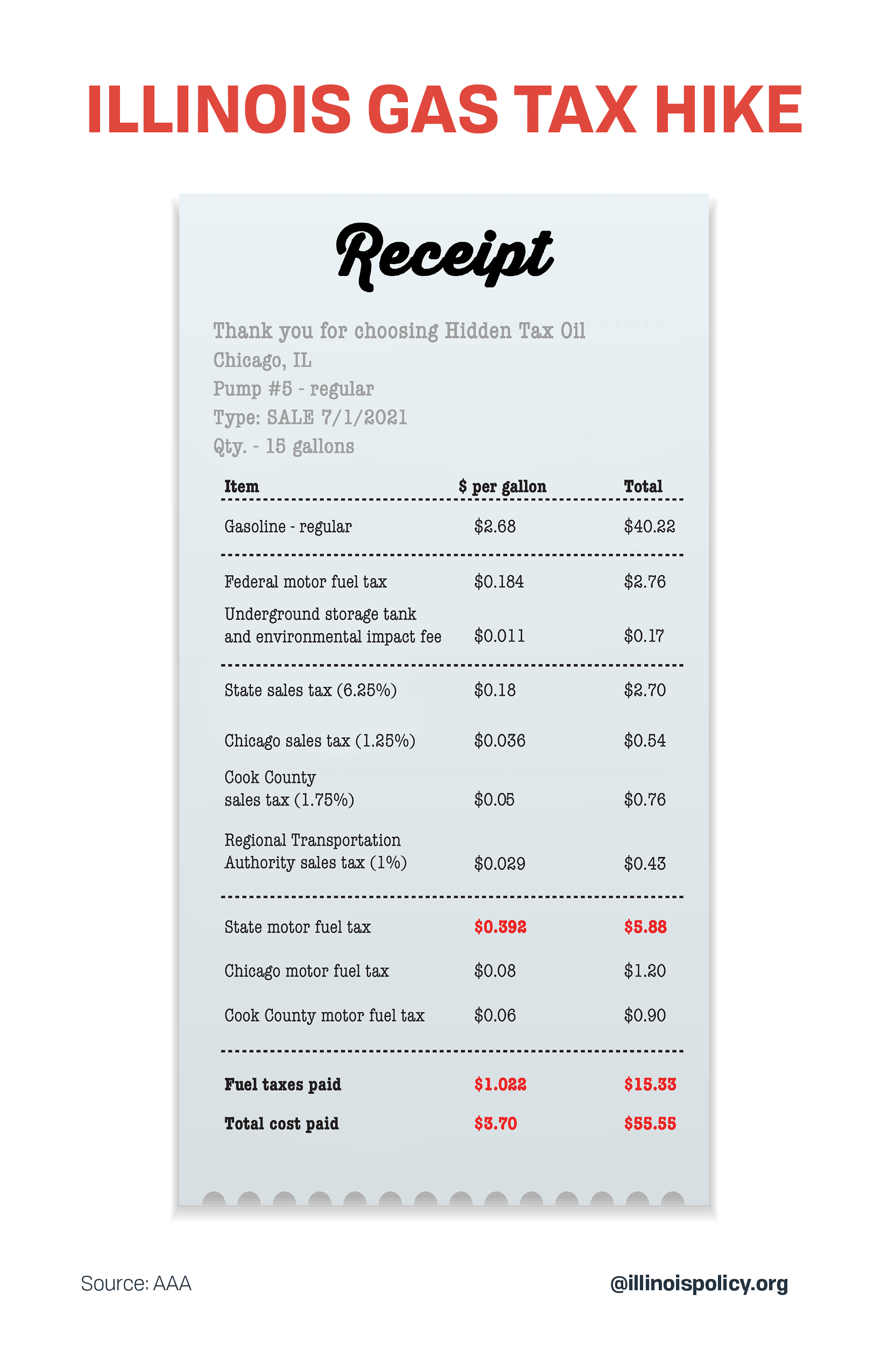

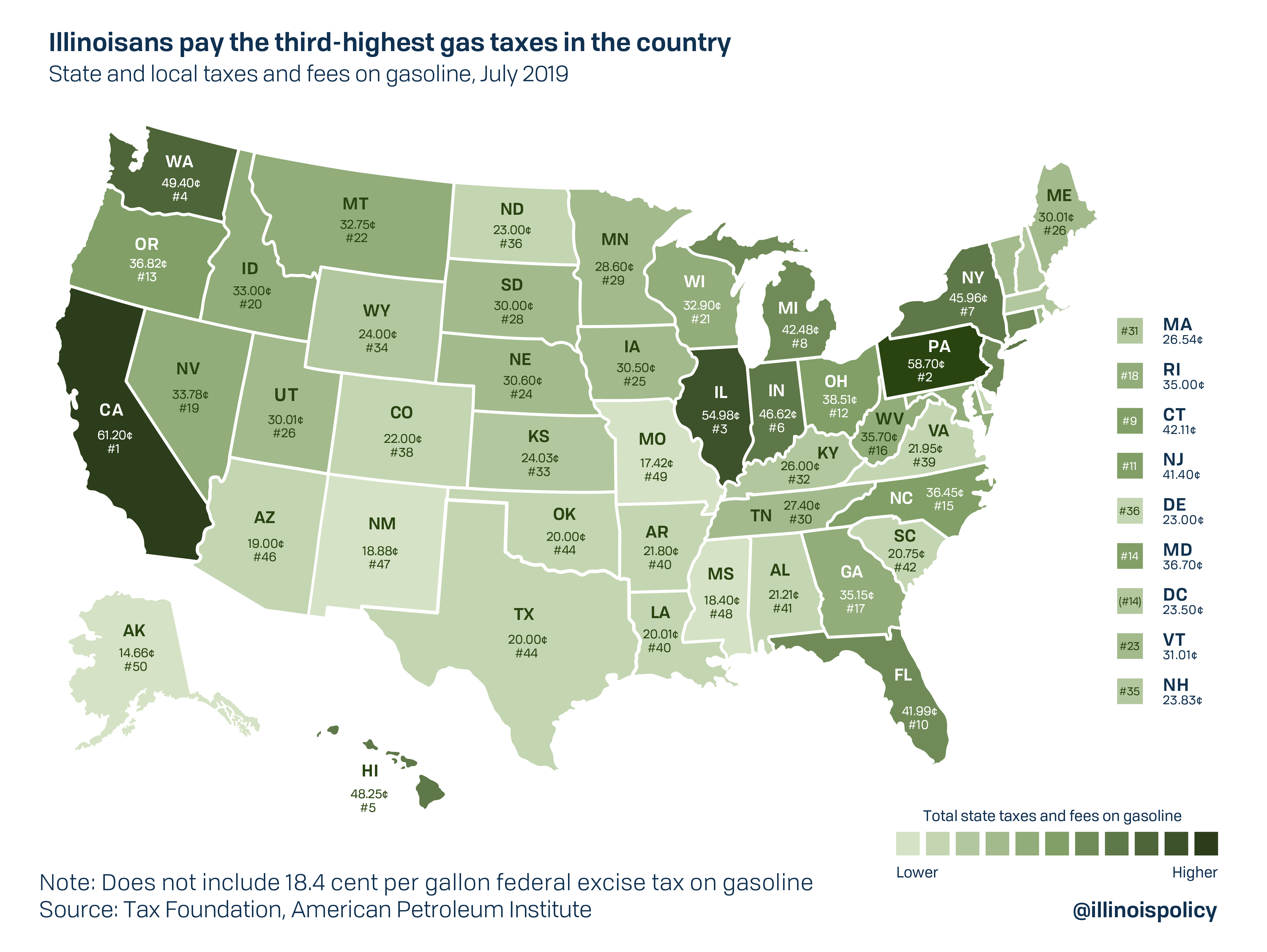

Illinois Doubled Gas Tax Grows A Little More July 1

2020 rates included for use while preparing your income tax deduction.

. Look up the current sales and use tax rate by address. Special Road and Trail Event Permit. Our website is available 247 as is our online payment program.

Heres how Dupage Countys maximum sales tax rate of 105 compares to other counties around the United States. Previously the rate for service and parts was 775 and 725 for vehicles. This rate includes any state county city and local sales taxes.

Buying a Car is Cheaper in DuPage County. Interested in a tax lien in. 2020 DuPage County Tax Rate Booklet.

Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the state on a sellers receipts from sales of tangible personal property for use or consumption. Opry Mills Breakfast Restaurants. County Farm Road Wheaton IL 60187 630-407-6500.

County Farm Road Wheaton IL 60187 630-407-6500. Sales tax returns or The Illinois Department of Revenue Form ST-1 are one of the most commonly audited forms or tax types in our state. Lowest sales tax 625 Highest sales tax 115 Illinois Sales Tax.

2020 Tax Year County Sales PDF 421 N. For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. This includes a full list of taxing districts in the county with their tax rates.

This rate includes any state county city and local sales taxes. Majestic Life Church Service Times. 2022 2021 2020 2019 2018 2017 2016 2015 Effective 2022.

The base sales tax rate in DuPage County is 7 7 cents per 100. The Dupage County sales tax rate is. The sales tax jurisdiction name is Elgin which may refer to a local government division.

Higher maximum sales tax than 97 of Illinois counties. Illinois has recent rate changes Wed Jul 01 2020. Up to 4 cash back By law interest of 2500 per month not to exceed 10000 is assessed after the due date.

The December 2020 total local sales tax rate was also 7000. Elmhurst Details Elmhurst IL is in DuPage County. DuPage County IL Government Website with information about County Board officials.

Use our local tax rate lookup tool to search for rates at a specific address or area in Washington. 1337 rows 2022 List of Illinois Local Sales Tax Rates. Registered tax buyer check-in begins at 800 am.

2020 Tax Year County Sales PDF 421 N. Naperville IL Sales Tax Rate. Restaurants In Matthews Nc That Deliver.

DuPage County IL Government Website with information about County Board officials. Sales tax returns or The Illinois Department of Revenue Form ST-1 are one of the most commonly audited forms or tax types in our state. DuPage County Administration Building Auditorium 421 N.

The latest sales tax rate for DuPage County IL. Water Sewer Utility Bills. The 2021 annual real estate Tax Sale will begin on Thursday November 17 2022.

If your Property Taxes are Sold at the Annual Tax Sale Held on November 1718 2022. You can print a 105 sales tax table here. Tax allocation breakdown of the 7 percent sales tax rate on General.

Elmhurst IL Sales Tax Rate. The current total local sales. California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated.

Local sales use tax rates by county. Some cities and local governments in Dupage County collect additional local sales taxes which can be as high as 425. Soldier For Life Fort Campbell.

IL Rates Calculator Table. The 2018 United States Supreme Court decision in South Dakota v. It will continue until all delinquent parcels are sold.

The Illinois state sales tax rate is currently. Average Sales Tax With Local. The 105 sales tax rate in Bartlett consists of 625 Illinois state sales tax 175 Dupage County sales tax 15 Bartlett tax and 1 Special tax.

Illinois has state sales tax of 625 and allows local governments to collect a local option sales tax of up to 475. These rates were based on a tax hike that dates to 1985. 2020 rates included for use while preparing your income tax deduction.

Quarter 2 2022 April 1 - June 30. Select the Illinois county from the list below to see its current sales tax rate. IL Rates Calculator Table.

The statewide tax rate is 725. The Illinois sales tax of 625 applies countywide. Income Tax Rate Indonesia.

County Farm Road Wheaton Illinois 60187. What is the sales tax rate in Dupage County. With local taxes the total sales tax rate is between 6250 and 11000.

2020 rates included for use while preparing your income tax deduction. This rate includes any state county city and local sales taxes. DuPage County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax.

Dupage County Sales Tax Rate 2020. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. Essex Ct Pizza Restaurants.

The current total local sales. Quarter 3 2022 July 1 - Sept. Some areas may have more than one district tax in effect.

Sellers are required to report and pay the applicable district taxes for their taxable. 82500. As of May 20 Dupage County IL shows 4576 tax liens.

The minimum combined 2022 sales tax rate for Dupage County Illinois is. Illinois has a 625 sales tax and Cook County collects an additional 175 so the minimum sales tax rate in Cook County is 8 not including any city or special district taxes. Our website allows you to print a duplicate tax bill pay your bill see assessment information view 5 years of property tax history and 5 years of sale history.

After the sale the property owner has up to 25 years to redeem the property and keep the home. Those district tax rates range from 010 to 100. This is the total of state and county sales tax rates.

You have up to the day immediately before the sale to pay all delinquent taxes and other costs to stop the sale. Download the latest list of location codes and tax rates for cities grouped by county.

Will County Board Approves New 12m Gas Tax Atop Doubled State Tax

Referendum Faqs Villa Park Public Library

How Much Is The New Illinois Gas Tax Hike Bigger In Dupage Lake Counties Abc7 Chicago

State By State Guide Which States Require Sales Tax On Vitamins And Dietary Supplements Taxvalet

Is Food Taxable In Tennessee Taxjar

Capsim Compxm Winning Guides And Tips Part 2 Tips Guide Strategies

State By State Guide Which States Require Sales Tax On Vitamins And Dietary Supplements Taxvalet

Lake County Looks At 4 Cent Gas Tax Hike Using Law That Doubled State Gas Tax

Is Food Taxable In Tennessee Taxjar

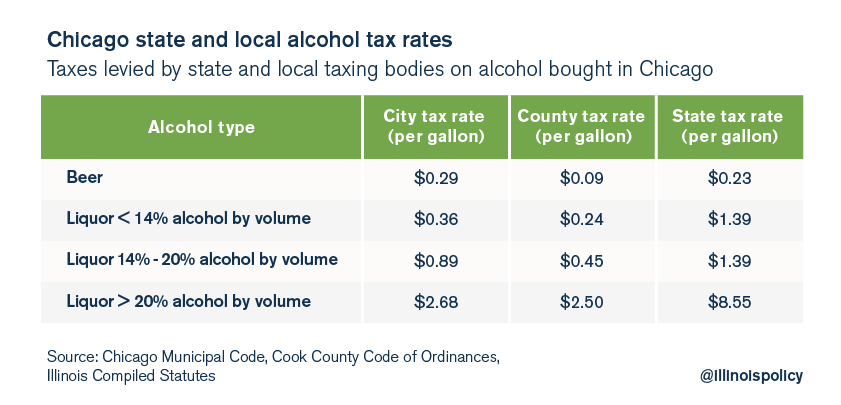

Chicago S Total Effective Tax Rate On Liquor Is 28

Is Food Taxable In Tennessee Taxjar

News Updates Dupage County Chairman Dan Cronin

Will County Board Approves New 12m Gas Tax Atop Doubled State Tax

How To Compute Real Estate Tax Proration And Tax Credits Illinois